Most of us are used to a variety of self-service booking solutions – in app or on web – from booking our next meal for pick-up or an appointment at the hairdressers to searching for the right flight and carrier to Rome.

In some industries, customers are asked to call customer service before they can get in touch with an advisor. The banking space is one of those industries where banking advisors and service employees spend a lot of time on administrative tasks such as: managing calendars and making sure that it is up to date, slotting in time to prepare for advisory meetings, and changing meetings on behalf of clients.

Similarly, the clients do not have an easy or efficient method either, of booking meetings with their advisors at their convenience. Everything has to go through a service agent first.

&Money and Trifork saw an opportunity to address these pain points in one solution that would benefits both clients and advisors.

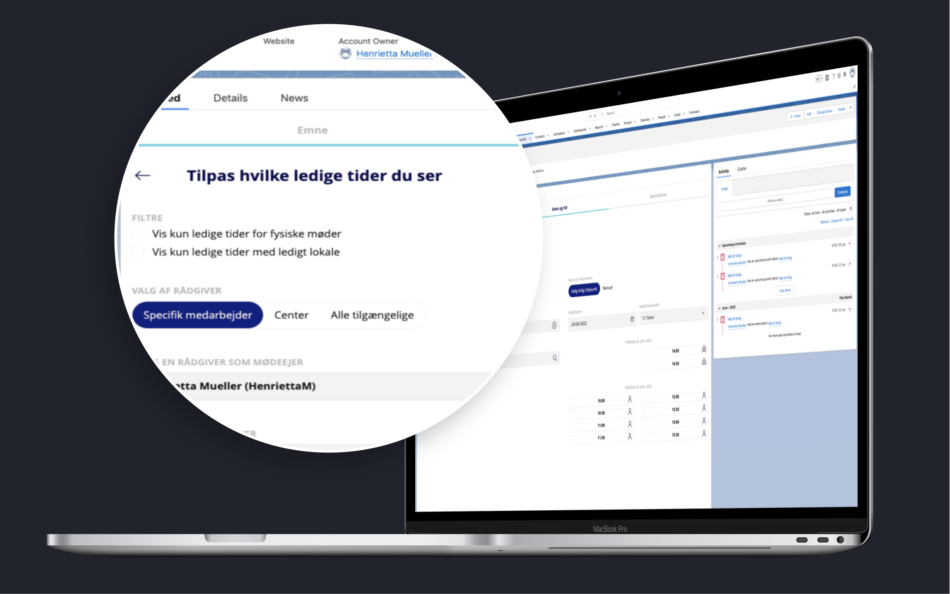

The objective was to enable clients to book their own meetings through a digital self-service portal, with their banking advisor – the meeting booked is then directly slotted into the advisor’s calendar. This would give more control and accessibility to the client, while at the same time, allowing the advisor not to spend time on ensuring that the calendar is up to date.

The second objective was to enable advisors and service employees to easily find open time slots for a meeting, based on the advisors’ skills and availability, with the added benefit of including meeting room availability. When a meeting is booked either by a client or service employee, it should automatically create an opportunity in Salesforce and book the meeting in Outlook.

The final objective: To synchronize meetings and available timeslots between Salesforce and Outlook. This means that if anything changes in either platform, they would automatically update each other, for example, if a meeting was moved, extended or covered another subject than what it was initially booked for, it would be updated in both systems.

“By introducing &bookme in Nykredit we have reduced our time spent on booking and calendar management. This allows us to free up more time for customer service and care. Also, it has reduced the cost related to our administrative processes. As an extra benefit, we are establishing valuable insights into our customer interactions. This will enable us to further improve the customer experience”

The outcome was the &bookme solution, which met all the previous objectives, with a time to market of only 6 months. &bookme is fully customizable to adjust the booked time length, based on meeting agenda or subject. This means that the bank can set up predetermined time slots for each subject. For example, for meetings concerning budget and general management of personal accounts, a predetermined meeting time would be 30 minutes with 15 minutes preparation time booked into the advisor’s calendar. While, on the other hand, a meeting about private banking or pension would take 60 minutes with 30 or 45 minutes of preparation time set aside for the advisor.

All of this is fully interchangeable depending on the business and what offerings the bank is giving to their customers. With short set up times, the system can continue to develop with the banks evolving business.

The Salesforce development has been done in Salesforce using LWC (Lightning Web Components) and APEX, with a Azure Kubernetes cluster as backend. The solution enables easy onboarding of new banks with different CVI’s in the future.

Finally, and most importantly, the &bookme system features a security model which has been approved by the banks, since it manages personal data.

As a result:

The solution is operational at Nykredit, and SparNord and Arbejdernes Landsbank are preparing for launch. Because the platform can easily be integrated into the banks’ existing systems, &bookme is currently being offered to other banks in Denmark and Europe who have a similar need of finding a simple and efficient way of working for their advisors.

Content