In 2021 Trifork entered as partner into the FinTech company &Money together with the partner banks Spar Nord, Nykredit and Arbejdernes Landsbank. The combination of domain knowledge and customers of the three major banks and the tech capabilities of Trifork has already proven to be a powerful cocktail.

With competing financial systems closing in on banking offerings and the need for banks to innovate and offer more digital solutions, especially for business customers, a new business platform was defined by &Money and Trifork.

As a result, the business platform bconomy will be launched first half of 2022 and will be frequently extended with new features.

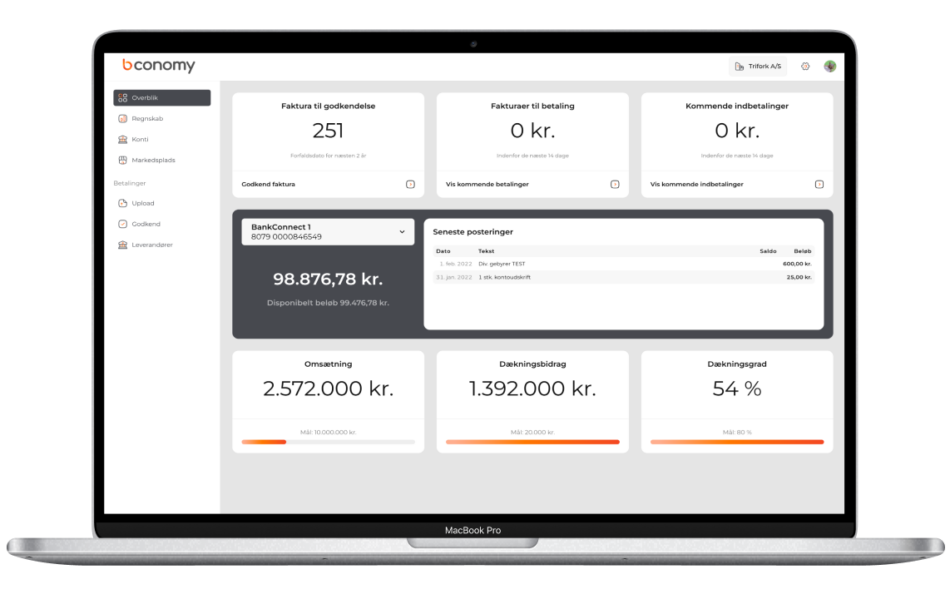

The initial focus for bconomy is to provide a business platform for small and medium sized enterprises (SME). A platform that can make it easier to conduct financial transactions, take business decisions based on valid insights and get the business and financial state of the company. This is done through application of technology, data and a user-friendly solution focusing on: “More company value, less administration and worries”.

bconomy is a platform for banks and other 3rd party FinTech companies. Banks can provide the solution to their own customers and other FinTech companies can provide their offerings through bconomy. in the marketplace and get access to all the bconomy customers. This FinTech ecosystem will be a significant part of the bconomy roadmap.

For SMEs, bconomy. The main difference between bconomy and its competitors will be the generation of insightful notifications, which helps the decision maker to take the optimal business decisions. All notifications will be based on the companys own data and bconomy will not only be a platform where you add apps, but also be the place you need to be to run your business.

“bconomy could be a true game changer in the business. It was key to have a leading tech partner in Trifork, with their experience and knowhow within Fintech and ability to turn ideas into a solution in a very short time.”

bconomy offers a marketplace where smaller FinTech companies with very specific niche capabilities can offer their services to SMEs – similar to the App store concept.

Some of the features that are included in the first release of bconomy are:

Less than one year ago, Trifork and our &Money partners kickstarted the product development in a lean process with a de- sign thinking workshop. Now, within less than 10 months, bconomy is launched taking advantage of Trifork’s experience within building transaction-heavy applications with fast user-adoption. The development speed and short time to market are important as the market for integrated business platforms is highly competitive.

“The roadmap for bconomy includes interfaces to more ERP systems and also a PSD-2 bank interface. bconomy will later be extended to support more complex companies like corporate groups. Additional features will be added as bconomy is dedicated to form a user community and listen to user input and feedback.

Content