In Denmark, citizens and residents can not get NemID, which you need to access existing digital solutions, until they are 15 years old. In 2017, Spar Nord saw an opportunity in the market to provide children earlier access to mobile banking, adapted to their needs. Security competencies was the starting point for Trifork when we joined as a technology partner in 2018.

In 2019, Nykredit joined and became a co-owner of the solution and in 2020, Arbejdernes Lands- bank joined too. This strong combination of domain knowledge by the banks and technical expertise from Trifork paved the way for a successful collaboration and winning solution.

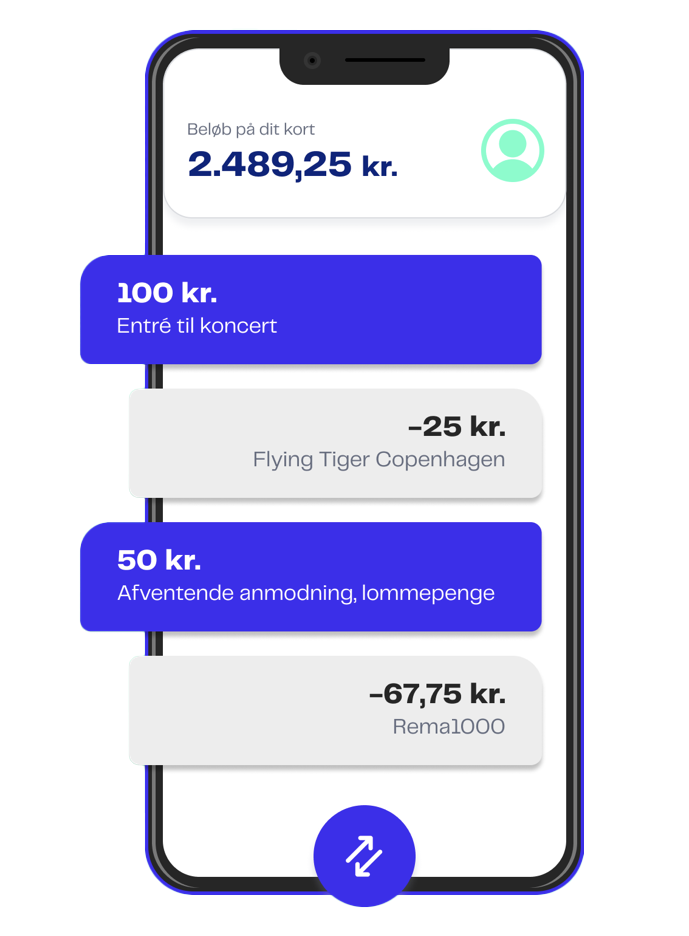

Young Money is a digital solution available to all banks seeking to offer their family segment of customers a 100% parent-controlled digital and user-friendly money & savings universe for children. The overall goal is to help them learn about money and its value.

“Young Money is a true end-toend digital product, with a high degree of user customization. The co-creation across banks and a leading tech partner has delivered a great product in a very short time – I believe this could set standards for how we will work in the future.”

How do you develop a solution that is secure enough to be applied in the banking world? There were many legal, technical, and security barriers that the team was up against. They applied Microsoft Azure KeyVault/Hardware Security Module, combined with Trifork developed cryptography, to enable a secure way of handling sensitive data.

Trifork redesigned the architecture to a cloud-native application and moved the solution to Microsoft Azure Cloud, in order to allow easier implementation for future banks. This was accomplished in just four months. Young Money was one of the first customer-centric solutions that used cloud technology.

The security part of the app is based on Trifork Identity Manager, which links two phones together in a safe and secure way – via this platform, the migration to the upcoming national MitID in Denmark will be seamless.

This new digital banking universe has opened up a world for children aged

7-17 and now gives banks the ability to offer a product that didn’t exist before. The unique team set-up was the key to success – because, despite the solution being created by three different organisations, it cultivated an environment of effective teamwork and true co-creation.

Arbejdernes Landsbank introduced Young Money in the first quarter of 2021 and the next bank will launch in Q2. More Danish banks are expected to join the Young Money universe in 2021.

35K+

12.5K

4

Content